"Let the good times roll" and 9 Questions with David Lavergne

Question 1:

Tell me about your background. Where are you from? Where'd you grow up?

David:

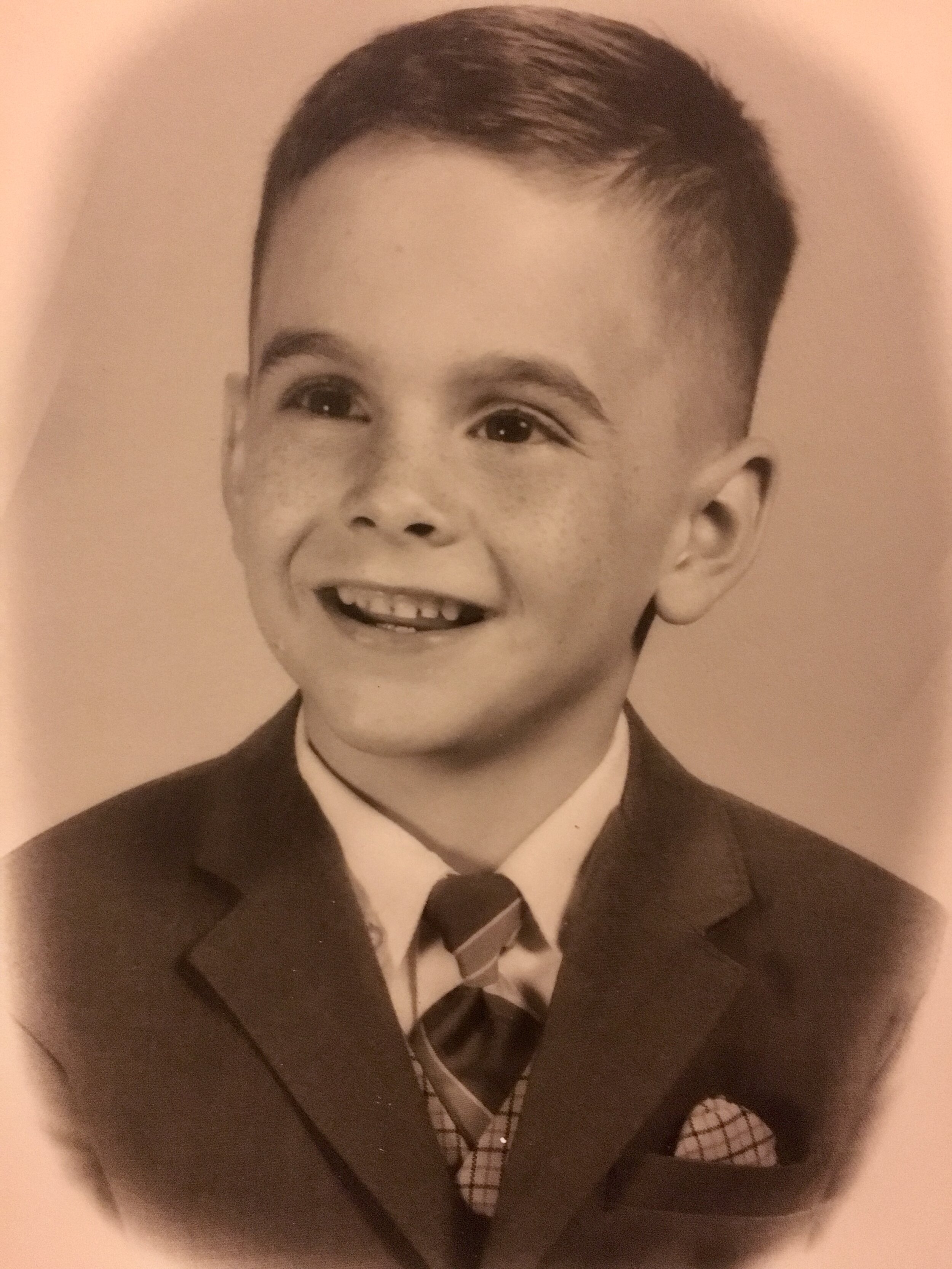

I grew up in South Louisiana, specifically Lafayette, in Cajun Country. It's all about good food, good people, and good times. The classic saying down in South Louisiana is, “Let the good times roll.” They say “Laissez les bons temps rouler,” right?

I graduated with a finance degree in 1984 from the University of Southwestern Louisiana. The Ragin' Cajuns! The semester after I graduated, they changed the name to the University of Louisiana.

When I graduated, the economy was terrible. Lafayette is driven by oil, and the majority of jobs were hard to find. The good times had ended. A couple of banks were hiring, but there really wasn't that much going on.

Through a little bit of networking, I ended up working for Reed Tool Company, a manufacturer of tungsten carbide and diamond drilling bits. It was one of those things…the moment you got the job, you knew it was just a matter of time before it would end.

You started watching the price of oil and the number of active rigs. The numbers kept going down and you just knew it was a matter of time before there'd be more layoffs. And I was the young kid, just fresh out of college! I got knocked down early-on in my career after just eight months. It was a unique learning experience. It was time to move on—to Atlanta!

Question 2:

How did you wind up in insurance?

David:

In 1986, Claire (my wife), who I met in college, and I moved to Atlanta. In the ‘80s, Atlanta was describing itself as ‘the land of opportunity,’ and people were flocking there.

With my finance degree, I went to work for General Motors Acceptance Corporation or GMAC, the financing arm of GM, and my earliest introduction to insurance was through their Motors Insurance Corporation. GMAC created Motors Insurance Corporation in 1939 to enter the “vehicle insurance” market! MIC was used as an insurance provider for GMAC floorplans for dealerships. At the same time, MIC was a tool to sell Corvettes for GM, since no other insurers at the time wanted to insure Corvettes! In May 2010, GMAC rebranded itself as Ally Financial.

It was a lot of fun and I met some wonderful people, but it was General Motors, a big, big company. You're just a number.

Not long after I joined GMAC, I received a call from a recruiter. I was only 22 years old—I didn't know what a recruiter was! He presented two opportunities to me. One was in insurance and the other was in the wine industry. Naturally, I chose insurance 😊.

The pitch for insurance was, “Here's an opportunity to work with small business owners across the country, who own insurance agencies and help them drive business success."

It was with Safeco Insurance Company, a good, strong insurance company headquartered in Seattle, which is now part of Liberty Mutual. I joined Safeco in December of 1987 in Stone Mountain, Georgia, in the Atlanta area.

I look back now and I chuckle. My background in finance and sales at Reed Tool Company were key to landing that job. I had kept my production reports for my territory at Reed, so it was a proven record of the sales process and my sales success.

I didn't realize it then, but that was data! Data's always been the key for everything. Data put me in a position to join a wonderful company.

Question 3:

Did you stay in Atlanta for the rest of your career?

David:

Oh, no. Every three years or so, Safeco sent you a new set of luggage for your new opportunity! I went from Stone Mountain to Nashville, back to Stone Mountain, to Indianapolis, and then to the home office in Seattle, Washington.

In 2004, I received a call from another recruiter and took a flyer out to the East Coast to talk with Hanover—then it was called Allmerica Financial. I joined Hanover at their home office in Worcester, Massachusetts, but I wasn't there a long time. Only two and a half years. Although I was there for a short period of time, it was also a fantastic experience!

While we were living in Massachusetts, I started getting calls from people who wanted me to return to Seattle. I had an opportunity to return to Safeco or join Travelers in Seattle. That's when I joined Travelers, as Regional President of the Northwest Region. You know the old saying, "When you aren't looking for anything, opportunities and doors seem to open up."

One of the many businesses that Travelers had was our energy practice in oil and gas. Not many people inside of our industry are actually exposed to the oil and gas industry. Who knew that many years later, I would be in a position where the knowledge and information that I learned at a young age would help me? This became quasi-full circle for me when I moved to Dallas in 2011 with Travelers as the Regional President, South Central Region. Oil & Gas was a significant operation within our business insurance segment.

So I’ve worked for Safeco, Hanover and Travelers. All three great companies—a total of 34 years in the insurance industry.

I’m very blessed to have been in the insurance industry. It's been a great adventure. I have met a countless number of people inside and outside the industry and have longstanding relationships that date back over 30 years, simply because of working in the insurance industry.

I never would have experienced that or had those relationships, and still have those relationships today, had it not been for the insurance industry—and had it not been for the poor economic times in Louisiana.

There's a reason for everything.

Question 4:

Do you ever get back to Louisiana?

David:

We do. Obviously, the pandemic has thrown a little bit of a wrench into that. We were last there in October of 2019. My Dad had passed away, and my Mother preceded him in death the prior year.

My younger sister, Melanie, lives is in Lafayette. (I have an older sister, Suzanne, who lives in Tucson, Arizona.) I still have aunts, uncles, nieces and several cousins and a lot of friends back from high school days, who reside in Lafayette.

We look forward to getting back. Hopefully, travel will return to somewhat normal times. Although, Covid-19 is reshaping views of normalcy.

Like most, we're waiting to receive the vaccine before we do anything of any significance from a travel perspective.

Question 5:

What are some of the challenges facing large insurance carriers, like your former employers, now or in the future?

David:

Top of the list—probably always top of the list—is finding talent.

The skillsets are always changing. What does a top-talent person look like today? Think 2021 versus 1987? How did skillsets change over that timespan? What are the characteristics, education and experiences that are needed today to drive business success? As the industry evolves, so does the dynamic around what each person needs to contribute to the collective success of an operation.

Many more people are retiring in the industry at a faster rate. They call it the Silver Tsunami. I'm relatively young. I'm 58 years old, retired—technically retired at 57. But I do have the silver hair! There still remains a knowledge transfer gap in our industry! Agencies, brokerages and companies must continue to bridge that gap between individuals leaving the industry to those who are coming up. The experiences and knowledge—beyond books, technologies, spreadsheets and theories—of those industry veterans have significant value and should play a key part in developing aspiring talent.

I think the second thing is technology. It's that continual drive for efficiency and effectiveness.

Insurance companies have always had enormous amounts of data on everything. How do you make it actionable? How do you turn it into a more efficient process for conducting business with an agent, a broker or a customer? As agents and brokers (including agency partnerships) get larger with companies and networks, it's an opportunity to be at the table to influence an insurance company's mindset and how they might be pursuing their own digital output, e-commerce platforms, and so forth.

People, technology and harnessing the data, as well as continual distribution changes. These are constant challenges for insurance companies large or small. By embracing data on their own, agents can be a stronger partner with a company and with a carrier, as they make future decisions on how to transact business with one another.

Question 6:

How do you think a company like AgencyKPI can address those challenges?

David:

I think AgencyKPI is helping agents, specifically networks (Agency Partnerships), have stronger financial discipline in the running of their operations.

In my experience and observation while working with networks, the individual agencies all seemed to have been very successful. They ran their agencies well and were aligned with their individual philosophies. Even though they were successful, they had varying degrees of financial discipline, right?

What I found fascinating was, the network itself didn't always seem to have that same rigor around financial discipline as many of the individual members. I recall being in many a meeting, like an annual planning meeting, and some networks had a very difficult time answering some simple questions, like, “What's your total revenue? What are your revenue expectations by location? What are your growth expectations by classification of business?”

Individually, I think most of the agents around the table, the members, would've known the answers to those questions. But there really wasn't a very quick response to, “How are we doing as a group?”

AgencyKPI is allowing data to be unified between all those members.

With the Harmony platform, networks can use information to better position themselves for the future, and use data to have a seat at the table with a carrier and have strategic conversations, like. “We are XYZ network. Our revenue is broken up into these top 10 classifications. These top 10 classifications drive 75% of our revenue. Thirty percent of our business is in fill-in-the-blank. Do we have a carrier who is looking to expand in that area, to create something new or to build upon what they have? It is an opportunity for a company to partner with our agency partnership as a result of our unique knowledge and success…documented by our own data.”

That is a whole different conversation than one that starts with, “How much will you grow with us this year?”

At the end of the day, AgencyKPI is really helping agencies and networks strengthen their financial discipline and use that data ultimately to be in a strategic position with a carrier and determine how you go forward from there.

Question 7:

Are you enjoying your retirement?

David:

Yes, very much. Retirement should not be underrated! We are enjoying life in The High Desert of Central Oregon! We are just west of Redmond, Oregon and just north of Bend, Oregon.

We first came out here in, I think, in 1999 when we lived in Seattle. It's about a six-hour drive from Seattle. Unlike Portland, there are seemingly 300+ days a year of sunshine. You get all four seasons. It's the high desert. It's a totally different landscape and geography than Seattle or Portland. We have mountains and lakes for hiking, golf, and kayaking. If you enjoy the outdoors, this is paradise!

We purchased our house here in 2017, so I had started building out my exit strategy, my retirement strategy, in the spring of 2017.

We arrived in Redmond at the end of March 2020. So, I only had the luxury (thankfully) of operating via Zoom and remotely for a couple of months—the new normal, which doesn’t seem much fun to me. My official retirement date from Travelers was May 4th (moved back from the original date of April 4th) and I turned it all over to very, very capable individuals. I haven't looked back since.

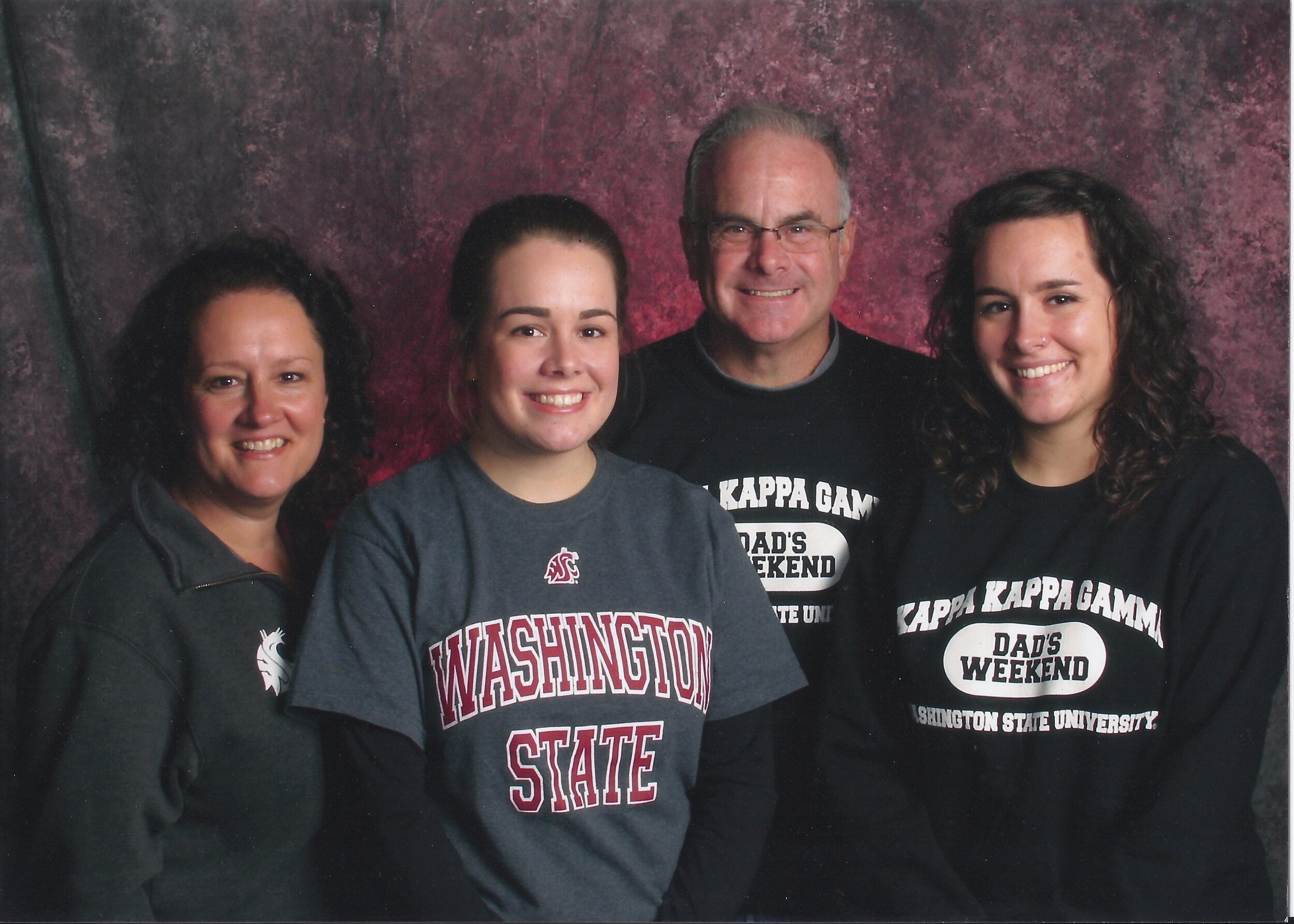

Retire when you are financially able to do so. Take advantage of your health. We are not guaranteed anything! Unfortunately, I've had friends of mine in this industry who have passed away at early ages. You hear so many horror stories of people getting an illness just a handful of years after retiring. We can control our retirement exit but we don’t control our exit from life. I just wanted to get a few extra years of enjoyment—which was a strong reason for me to retire at 57. That, and to be closer to our children! Our oldest daughter Lauren lives in Spokane and our youngest daughter Meredith lives in Seattle. It is fantastic to live in their time zone!

We’re trying to enjoy life and be part of something bigger than ourselves in a smaller community.

Question 8:

You used to travel frequently for business. How many miles did you used to travel?

David:

I traveled virtually my entire career. The last handful of years were no exception. I flew everywhere, whether it was to Kansas City, St. Louis and or Hartford, and all the places in Texas.

I guess I probably averaged about 85,000 air miles a year. It was 100-plus flights…a lot of short-hop flights, rental cars, and probably a couple nights in a hotel per week in the past 10 years.

While at Safeco in Seattle, I had some countrywide responsibilities. It was “leave on Monday, come back on Thursday.”

Early on, I didn't mind the travel. I actually enjoyed it. It opened up so many things for me professionally and personally. Eventually, the travel and all it entails becomes a grind.

It's going to be interesting to see how things change for the insurance industry as we come out of this pandemic. One impact should be travel. Agents & Brokers have always complained about the time-consuming aspect of insurance company visitation and certainly insurance companies have always complained about the travel expense, entertainment expense and so on. Well, commerce is still going on without travel and visitation. Insurance companies and agents are doing well—revenue is strong—without company people going to visit agents and brokers. There's a lot of phone calls or Zoom calls. So, it's going to be interesting to see what travel there is in the years to come.

Question 9:

Did you have a favorite golf course or two in some of those states and cities you'd visit?

David:

I have been so fortunate to play some wonderful golf courses all across the United States. The rounds were short, but the memories are very long. There were great courses in each state we lived in—and while the courses were great, the friends I had the opportunity to play those courses with are the reasons my memories are so vivid.

While living in Georgia, I was able play a lot of great clubs in Georgia, Florida and the Carolinas.

The highlight of my golfing “career” was when I had the opportunity to play Augusta National Golf Club in 1996 with two gentlemen, Mr. Phil Harison and Karl Kerzic, who lived in Augusta, and at the time owned Harison-Kerzic Insurance Agency, which is now part of the J. Smith Lanier operation.

I can still visualize the holes and the conversation and everything else. Mr. Harison was a long-time member of the club and was the starter on the first tee of the Masters for 60 years. He died in 2008. The stories he told … well, it was a day unlike any other.

Obviously, this was way before we had iPhone cameras in our pockets, so I had a couple of disposable Kodak cameras with me and was fortunate enough to take some pictures and still have those.

My most favorite golf course in the country is Sahalee Country Club in Sammamish, Washington. I was a member there in the 2000s—a fantastic place to live and play, wonderful friends and timeless memories. If there was only one place, I could ever play golf again, Sahalee would be it. Sahalee means “High Heavenly Ground.” Indeed it is.