"What drives your passion for Antique Cars?" and 9 Questions with John Tiene

Question 1:

You are one of 11 siblings in your family. Which one are you in the lineup?

John:

My father and his wife, Rosemary, had four kids. Rosemary was diagnosed with breast cancer while she was pregnant. She chose not to be treated to protect her child. Unfortunately, she passed away soon after my older brother was born.

A few years later, my father met my mother, who was a distant cousin of his first wife, and eventually they married. I'm the first of the second batch!

My mother swears I came out wearing a tie. In the family, I’m “The General.” Everyone knows if there's a problem to call me.

Question 2:

Where did you grow up?

John:

I grew up in northern New Jersey, just 12 miles outside of New York City in a nice little town called Nutley.

My father, Guy Tiene, was a schoolteacher. He was the head of the foreign language department at the high school. He spoke six languages. I'm still working on English.

My mother was born in France. She lived in Nazi-occupied France. To her, the US was this great place that had come over and liberated and saved them, so she wanted to see what the US was like. She was an au pair and later worked at the United Nations. Through loose family relations she ended up meeting my father.

Question 3:

What led you to a career in insurance?

John:

When I got out of college, I had a choice. I was very involved in local politics, and I could go down the political route and get a job in politics and then always be beholden to someone, or I could just get a normal job.

So I answered a Help Wanted ad for an employment agency looking to hire people for Allstate and got hired in their Claims Department.

While I worked claims, they found out that I knew a little bit about politics and they put me on their Political Action Committee. I ended up as Allstate’s Public Affairs Manager for the state of New Jersey.

Years later, I left there and went to work for a public affairs agency that managed the state's trade association representing insurance companies. I became the chief spokesman for the insurance companies as well as the vice president in a big PR firm. Four years later, I took the industry association out of the firm as a stand-alone trade association.

After about 10 years, we finally got auto insurance reform, which I was heavily involved in. At that point, I was burnt-out, so I went back to corporate and was an executive at OneBeacon Insurance Group.

After they sold to Tower Group, I started doing some consulting and got hired to run the ANE (Agency Network Exchange) until 2019. Now, I'm consulting and building a new agency network, Strategic Agency Partners.

Question 4:

What got you interested in politics?

John:

My family goes back in politics a very long way. My paternal grandmother was very involved in politics, so one day I walked into the headquarters of a local guy running for Township Commissioner and got involved.

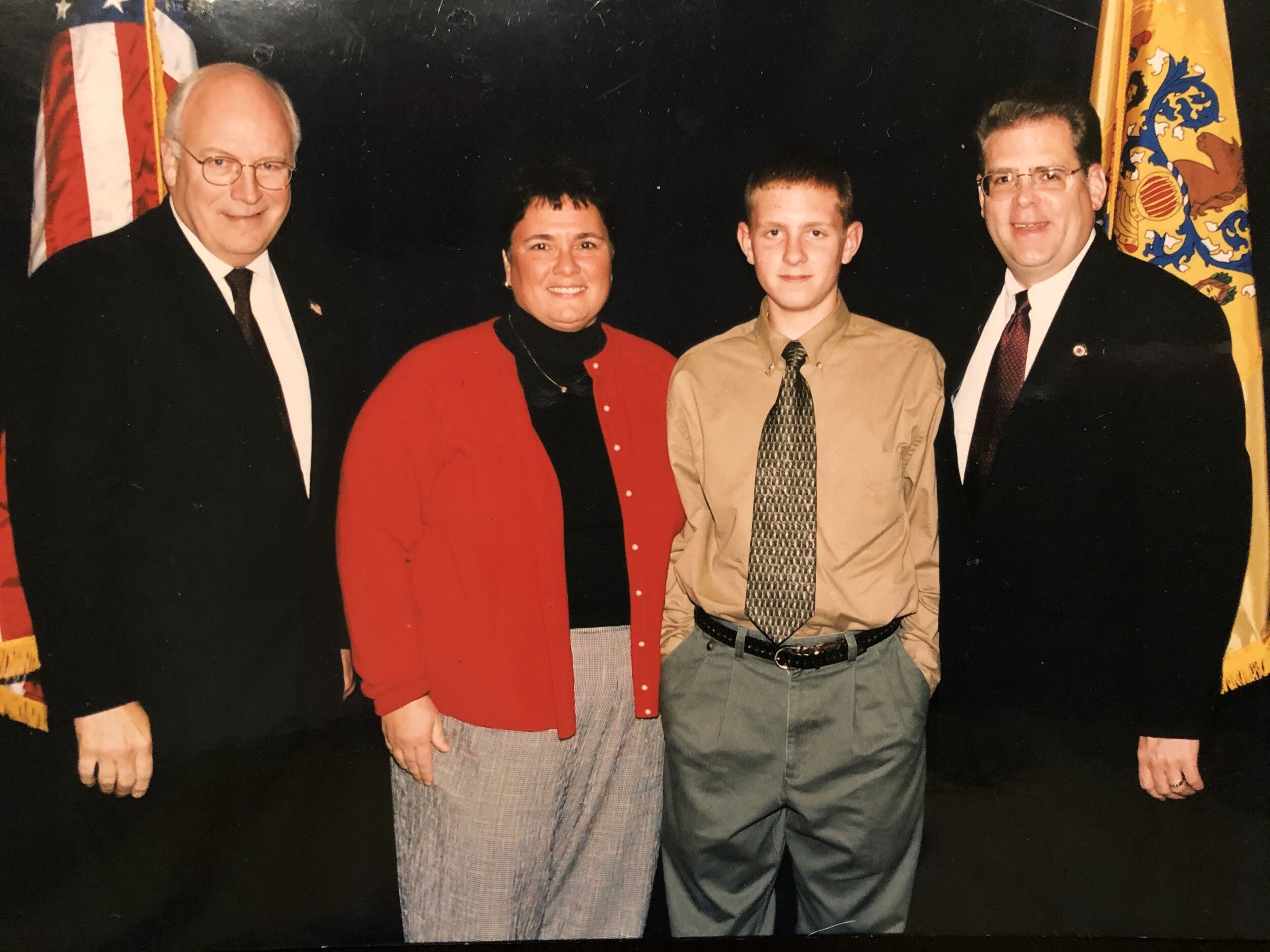

I’ve worked for a state senator. I've run local campaigns, state campaigns, and gubernatorial campaigns. I've been involved in raising money. I've even been a candidate myself. I came within a razor’s edge of being elected mayor, which would've been impressive because the guy had been in office for 20 years.

One of my favorite things is to walk neighborhoods in the fall, knocking on doors and talking to people. You meet really nice people and you learn a lot.

I think people have a responsibility to be involved in the communities in which they live—it's how our government is based.

Throughout my entire career, I've always kind of balanced work along with being engaged in the community. In my hometown, I was president of the Recycling Organization, president of the Fire Company, president of the Historical Society, and president of the Jaycees.

Question 5:

As a consultant, you share a lot of advice. What's your favorite piece of advice you like to share?

John:

When you're consulting and helping people understand how to get from point A to point B, it can be scary for a lot of folks and overwhelming.

I just look at them and I say, "Listen, you can eat the elephant, but you do it one bite at a time."

That's really what I try to help people do: Break-down what they need to do into smaller pieces so that they can accomplish their longer-term goals.

Start with step one. Once that’s accomplished, they feel good about it. Okay, now you can go on to step two. Accomplish that, then go on to step three.

Then it's not as overwhelming. You don't need to take it all on at once. One little piece at a time.

Question 6:

You’ve written about embracing technology and adapting to change. Why do you have that mindset and why do some people fear technology?

John:

Technology can be scary for many people. It's not necessarily easy to understand and there can be generational issues. There's a lot of unfortunate misunderstanding and apprehension.

It's also just change. People are generally apprehensive about change, but change is a reality.

It helps to see technology as a tool. You can use those tools to build and operate your business to have more engaged relationships, more efficient operations, and more effective relationships with your customers, employees and prospects.

I deal with a lot of agents and some are very overwhelmed with technology—particularly social media and stuff like that.

But there's a reality here. People use smartphones for everything. And COVID, in particular, has exponentially changed how people operate their lives, because in a lockdown situation it’s become a lifeline. I can order food, I can order essentials. I can order furniture. I can manage my finances. I can do damn near everything with my smartphone.

So I look at the agent and I say, "Can they communicate with you with on this?" If they can't, you've lost credibility and you've lost an opportunity to engage with your customers in a different way than maybe you're used to.

Question 7:

At AgencyKPI, we don’t think disruption is the right way forward. What do you think about our approach?

John:

AgencyKPI really is a game-changing technology for the insurance distribution channel.

Actually, I think in many cases you are a good disrupter because you're giving agents data and information they've never had before, and you're giving the networks that they work with the information and data they've never had before. They can now have more meaningful, more intelligent discussions with their carrier partners, as well as the agents that they work with.

Question 8:

You were Chairman of the Brain Injury Alliance of New Jersey. What led you to be involved with that?

John:

New Jersey is the most densely populated state in the country and, years ago, we had a serious problem. We had unlimited personal injury protection with personal auto coverage, which wasn't working, because it was unlimited coverage. An insurance company could be on a claim for 30 years!

I worked in public affairs for the insurance industry and eventually we got a reform in 1989 that capped the amount of personal injury protection.

During the reform process, I constantly butted heads with Barbara Geiger-Parker, the president of the Brain Injury Alliance.

Barbara and I had a very respectful relationship. I truly respected what she was doing. She was advocating for her community and she's a good person.

One day, the chairperson of her organization calls me and says, "We'd like you to serve on the board."

Well, this is like Nixon going to China, but I went on the board.

Initially, people would say, "You're working over there? You're helping those people? They're always against us."

I’d reply, “Yeah, they're always against us, but they have a real cause.”

So I served as a bridge to the insurance industry. They understood us and we understood them. I got a lot of insurance companies to donate a lot of money. They actually created an alliance with one of the major insurers here in New Jersey around teenage driving, because that's one of the biggest generators of traumatic brain injury with young people.

They had some fundraising challenges, so we created an annual gala. Becky Quick who's a host on CNBCs Squawk Box, is the master of ceremonies every year. Her brother was traumatic brain injury victim. He was in a serious car accident when he was very young. I chaired that committee for about 10 years. We raised more than a million dollars.

Imagine. You're sitting in the hospital and a loved one has had a traumatic brain injury. Your life has just turned upside-down. What do you do? Where do you go?

Fortunately, you can go to the Brain Injury Alliance. They have support groups, counselors, and a plethora of services and support mechanisms that can help.

Overall, it was a wonderful experience. Really good people doing really good work.

Question 9:

What drives your passion for Antique Cars?

John:

When I was very young, the town museum wasn't so far from my house. The little old lady who ran it had a 1952 Buick. This is in the late 60s-early 70s. I became a volunteer at the museum and she would occasionally drive me home in this big old car.

Then my grandfather had a 1963 Ford Galaxie 500 that he gave me when I was 18. (It was actually a plan hatched by my uncle to get my grandfather to stop driving.)

Between the time I got my license and the time I bought my first new car when I was 26, I owned about 32 cars. Buy for a few hundred, run them till they stopped, and get another.

I dated my wife and courted her in a '63 Chevy Bel Air.

In 2003, I was finally at a point in my career where I had a couple extra dollars. My wife said, "Well, maybe you could get your car now."

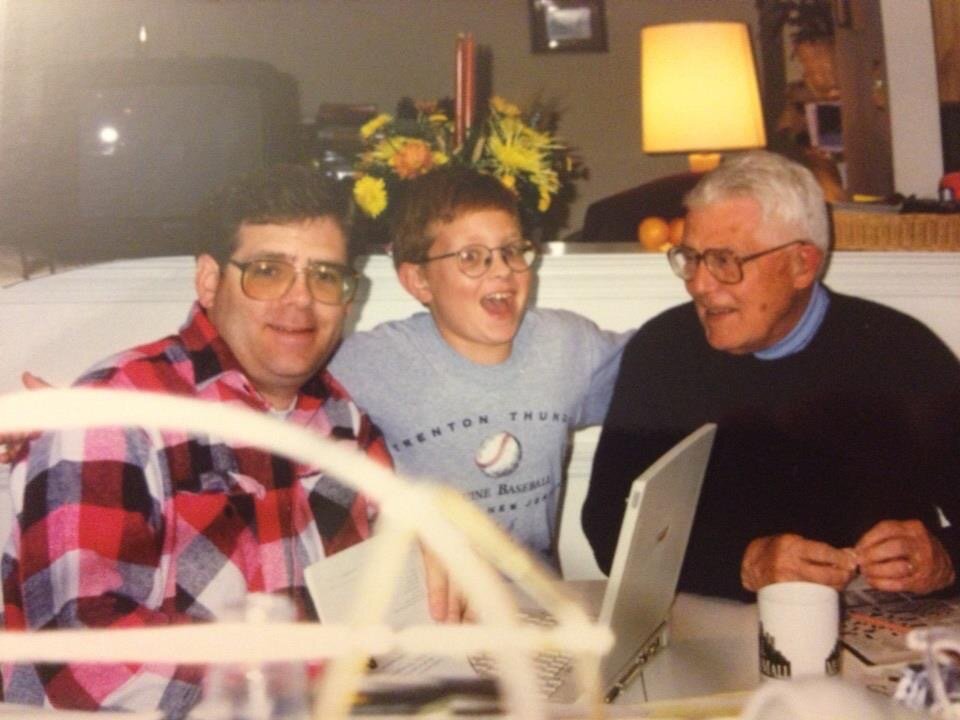

My son would look at the ads in the back of old car magazines, and he says, "I found your car."

He throws it down and there's a picture of a 1950 Buick. Black, big and a lot of chrome. It was in Hershey, Pennsylvania, which is about an hour and a half to two hours from our home.

The price was right, so I picked up the phone and talked to the guy. Turns out, the seller is one of the founding executive directors of the Antique Automobile Club of America. I sent him a deposit.

I still have it. We call her Queen Latifah. I have three cars now. I've had up to seven: the 1950 Buick, the 1940 Chevy, the 1960 Galaxie 500, the '84 Cadillac El Dorado Biarritz, the '66 Continental Convertible and the '52 Continental Mark II.

When I was at One Beacon, it became the underwriting company for Hagerty, the largest insurer of collector and antique cars in the world—certainly in North America.

I would get called into meetings because I was the only one that understood the antique car hobby.

I’d say, “They treat these things better than their wives. If it rains, they don't go out. If it snows, they don't go out. If it's too hot, it doesn't go out. Too cold, it doesn't go out. These are babies."

With normal auto insurance, you're running a loss ratio in the 50s or 60s.

With collector cars, the loss ratio is about 18%. You never have a loss, because we treat these cars like our babies.

But my cars are not show cars. I drive them. They polish-up nice and look nice in pictures, but they're not pristine cars. They're meant to be driven.

When you drive an older car, you can actually feel the road, you're actually engaged in driving. You feel it. The cars now—I love my newer cars—but you don't get a feel for the road. There's just more of a relationship between the road and you when you're driving an older car.

And there's nothing more relaxing than getting behind the wheel of my Buick, driving it out onto a country road. All my stress disappears.