“What’s your favorite guitar?” and talking about data with Ron Berg

We sat down with Ron Berg to talk guitars, ice fishing and data. We were so lucky to be joined by AgencyKPI’s very own Dan Goodwin. Here is the transcript:

The latest edition of the AgencyKPI Blog is also a podcast! Click below to listen!

Jason:

Ron and Dan, good to have you today on the podcast. You've both been in the insurance industry for a number of years. How do you know each other? Do you recall where you met?

Ron:

I think so, Dan, and you can tell me if I'm just making this up out of the blue, but I think we met after hours, if I recall, and it might've been AMSUG which is now NetVU Accelerate.

It was after hours, I was sitting with Jim Armitage, enjoying a nice adult bourbon. And I think you came by and introduced yourself, if I remember correctly.

Dan:

Wow. You're remembering a lot more detail. I remember being new to the industry and new to this whole kind of agency technology, and Ron was working for another carrier at the time.

I remember going to the conference and Ron was one of the people that my mentor, who I was taking his position said, "Dan, I'm going to introduce you to the people you need to know. Not the people who want to know you." His feeling was Ron Berg is who you need to meet.

So it was pretty easy as I went up and met Ron, and we've created a friendship. Really, mine was based on a lot of mutual respect for everything that Ron's done his knowledge from the carrier side, and then coming into the industry. And so, most conferences I'd run into Ron and then I would try to meet him for a drink or at least a dinner or something at almost every event.

Ron:

I do recall this buff guy. Dan had been working out like there's no tomorrow. And I'm sitting there and I've been working all week and I'm like "okay, I'm just going to give up now, let's just talk work." But that was Reno, which was just this... As anybody who was at that conference—just everything that could happen at a conference happened. There was an earthquake, a snow storm, high winds, a fire and a power outage. The only thing that didn't happen was locusts.

Jason:

That's funny. I'd love to hear more about your background, Ron. Where did you grow up?

Ron:

Central Minnesota. I'm from Lake Country. Minnesota is known as the Land of 10,000 Lakes. It's actually closer to 12,000. Come from central Minnesota, farm country. Grew up in a little town that was kind of like, I think of it as Mayberry-North. Nobody locked the doors. Even when we went on vacation. Just tell the police that we're going on vacation.

I grew up working farms, working resorts, which are around the lakes, and kind of just got into computers in high school, when you had a teletype that was hooked to a far away university and you'd put in a command and wait a few minutes and something will come back. So I was, I was at the very forefront of computer education, at least in my area of the U.S.

Jason:

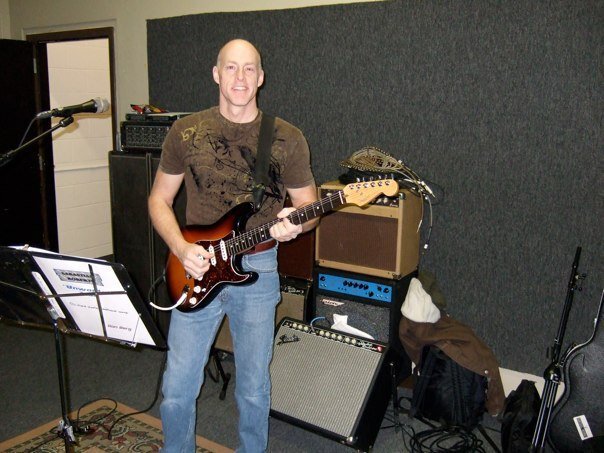

That's great. Before we get into insurance, I have to ask, cause I see a guitar in the background there. I guess you play guitar? When did you start? Who taught you how to play?

Ron:

I did. I moved the Twin Cities coming from this small town, assumed everybody looked at me and saw this hayseed. So I was really self-conscious and kind of hung by myself at first, not knowing that most people in the Twin Cities, Minneapolis-St. Paul, moved there from someplace else too. And so the house I was renting from a lady who was a friend of my parents, had a guitar sitting there. So I just picked it up and started playing and kept listening to the radio and playing along. I've never really had any training. Playing along with albums, ruining albums, by picking up the needle and playing over a passage. I can play most things by ear, but I couldn't play something from sheet music if you held a gun to my head.

Jason:

What's your favorite guitar?

Ron:

That's like saying, what's your favorite flavor of chocolate or permutation of chocolate? I love the Les Paul sound.

I've had Les Pauls for years, that thick Allman brothers, singing-type sound or Guns N' Roses thickness—the typical hard rock sound or heavy blues sound.

But I also love Strats. Stevie Ray Vaughan, he is my guitar hero. So once I learned about Stevie Ray Vaughan, I set-up all of my equipment to sound like him. And I love the flexibility of a Strat, the twanginess.

What I have now is called a Schecter, which is kind of, not the best of both worlds, but it's one of the better compromises that you can get that balance of Les Paul without the huge weight of a Les Paul, which, when you sing and play guitar, you got to be able to take a lot of breath in.

Jason:

Yeah, They're heavy.

Ron:

The Les Paul weighs down both shoulders, so it's tougher. So I like my Schecter a lot.

Jason:

Oh, that's great. I could talk about guitars all day, but we can't. We're going to have to jump to insurance.

What's the most important data or tech issue facing the insurance industry.

Ron:

To me, it's the access and flow and understanding of data. There is data there. Agents have been asking for years—through their systems, their management systems, and some of the other systems like AgencyKPI. How to get the most power from it?

Along with the carriers, along with the networks, along with the agents, bringing all that together, to provide clarity and ensure that the accuracy is there, that flow. There's unstructured data that's out there. There's structured data. There's data coming from public and private points. So I feel like we're at this nexus, Jason, where there is just so much to do with it.

Getting a clear picture of the flow and the possibilities and the power. I think that's the biggest challenge right now is understanding.

Jason:

Dan, you can add to that if you want to jump on any of those points.

Dan:

Yeah, so I agree with Ron, I think the... Everyone has best intention. Everyone, all these different stakeholders, have data.

Data is—what I'm learning is—really what people are thinking. Data is all of this unstructured, large amount of data in a data warehouse, and they want it provided to themselves so they can make decisions.

And what you're finding is, it's important for the industry to look at the customer and say, "What are they trying to solve?"

You just give someone data, you're creating another problem, because now they have to understand what the data is trying to tell them. The real focus for our industry now is to simplify the message, right?

What is the story you're trying to glean from the data? What are you trying to fix? What's the problem statement? And then it's on the people who provide the data to not give them data, but give them information that can be actionable strategy.

If we just start providing large amounts of data, you now put it into somebody's hands, where they have to create a query mechanism. They have to have a data mart that they actually can extract the data and run pivot tables to try to say, "What am I trying to say?"

Everyone's providing these pieces of the puzzle of data coming in, and I think coming together in an ACT format allows us to have a piece of the puzzle, but connect it to somebody else's piece of the puzzle so that we tell the bigger story.

A long time ago…with download, real-time quoting, and all these things…people took off their boxing gloves, came together and solved these problems. That's kind of where I feel data is at today. We're going to have to come together and understand that data has power as long as we work together.

Ron:

And to extend what Dan just said, I think from my longer-term view of the industry, I've been involved in Agents Council for Technology almost since its inception. To Dan's point, it was bringing people together to start to drive standards—carriers and vendors—around download and the first iterations of real-time quoting for personal lines and getting those key first components in place.

There is more willingness that I feel, see, right now to share insights, to share challenges than there ever has been. The industry is at a great place when it comes to the willingness to work together and not just try to hoard whatever that secret sauce is that's going to come out anyway.

But to yourself, it's everybody benefits by working together. With data, we've kind of stepped back a little, the willingness is there, but the confusion is, I think, greater than ever. And that's all of our jobs.

Jason:

We all hear this personally with privacy issues with our smartphones and stuff like that. And now we're talking about data, in an agent's business. How do you help agents overcome any fears or concerns about data?

Ron:

For a long time, a relatively long time, when “InsureTech” became the word, there was this fear about disruption. I really got sick of that because there was just so much to gain with partnerships. And now, those entities like AgencyKPI, and the other long-time vendors, and the carriers, are recognizing the great potential to work together, to streamline data, to clarify data and improve accuracy, to plumb the depths of unstructured data, and provide the carrier partners different insights on some of the underwriting aspects.

But from the agents, Jason, the standpoint there, it's clarifying what's going on in the industry…what is already there in their laps that they may be asking for, but don't know they already have, and then how to extend that power with actionable insights.

Things that they can take action on to not only serve their customers better, to work with their carriers and get information through their partners, like AgencyKPI, in a more expedited fashion. And, I guess, to streamline their workflows and save work—but to clarify those different components, as well as the security aspects that you were mentioning a bit earlier. So that continues, I think, to be the challenge, the fear is when you don't understand, you don't know where to start and that's Job One for all of us.

Dan:

He's right. The fear and the concerns around data are number one. The sheer amount and what do I do with it? It's coming in from everywhere and what do you do?

The reality is, the concerns are, is the data even correct?

Is someone running the data and has it been validated. Is what I'm seeing accurate? And even if it is accurate from their standpoint, if it's not provided in the same fashion from the other sources necessary to tell the story, and it's an apples and orange, you can't really tell the story.

So it lends into the importance of the data providers, the folks who have data, that are providing it, to come up with a standard. A way of defining industry-based terms, validating that, and making sure that we deliver in a consistent method. And one thing Ron said, and I would reiterate is, to improve data quality. To have a hundred percent accuracy in the data is always a tough situation—to say that we're a hundred percent accurate—because a lot of it is point-in-time reporting.

As of today, this is the way it looks. Ron runs his data tomorrow, it may look a little bit different. But we need to be able to identify those gaps and at least speak to that. Tell the customer where the differences are, but stay to the standard definitions. And one thing I will speak to, as far as AgencyKPI, that I've learned as I've gone through the journey that I have, working with a lot of carriers and networks and agency customers. The carriers are appreciating being able to provide the data because now we standardize it. Very simple. Just very simple requests that we're actually building into AgencyKPI. But we standardize the terms and we work with the carriers and they're like "yeah, if it's standardized, you're defining it, we can provide it.”

But when they don't really know what they're supposed to be providing in there, they think they're providing an agent one thing, and the agents getting something different from another carrier, it's really hard to bring the two together to understand the story you're trying to tell.

Ron:

To Dan's point about creating those standards. There's been an influx in the past year and a half of entities coming into our industry claiming to have the silver bullet for data: "We've got everything you need for data."

And that's added to that confusion, I think. And all of that is natural and organic, but it's getting consistency around how we talk about data, how we work with the data and that's the standards. That's what it comes down to.

Dan:

Ron runs in part of his ACT organization, a work group called Data-Driven Industry, and it really is a great opportunity for people listening to this to get involved. Ron has an open-door policy to where he can have technology providers, carriers, agencies come together, and we can start defining those standards. And it happens when we come together and we communicate and we talk and we work together. That's when things happen. I really do want to call out and appreciate ACT for actually pulling this together, because it really is an area that has done a lot of things, historically, where we bring people together. But I feel like through this work group, we have a great opportunity. And Ron, I don't know if you want to elaborate on that work group.

Ron:

Yeah. I'm just the facilitator of that discussion. We've got some great people in that group. In fact, that Data-Driven Industry work group has more interest from the carriers and vendors and agents equally than pretty much any other work group we have.

We haven't created a product, but we've talked through, "Okay, agents, what do you think of when the word ‘data’ is used? What are your challenges? What are your perceptions? What are your needs and what is success?"

We've done that with each of those stakeholders. And now we're bringing that together and we're going to kind of create a ‘state of the state’ if you will.

With data, I think what we're going to do—because it's like AI, it's evolving, it's being defined with standards. But we need a ‘state of the state’ so that all of those stakeholders, like you were talking about, Jason, “How do you help agents overcome their fears around data?” This is intended to help. Here's a snapshot of what data and business intelligence, analytics, actionable intelligence, collaborative planning, and benchmarking look like right now. And here's how you can take that, move it forward.

Jason:

Yeah. That gets to the advantages that agents can look forward to with technologies like ours at AgencyKPI. Elaborate on that just a little bit. What are some of the advantages? You know, give me an example, possibly an agent can look forward to. Dan or Ron?

Dan:

Well, I guess Ron, I'll take the first one.

I think what they're going get, the advantages is actionable information. I think it's important that we take a step back and say, "What is the agent's job in the industry?" It's to sell insurance and to service the customers.

It's not necessarily to be a database whiz or a data scientist and understand the algorithms of what goes into rate. That's what other folks are supposed to do. That's the teammates. There's other parties that actually should be providing that information to the agents so they can spend the time doing what they need to be doing.

I think that what they're going to get through this kind of work is actionable information to a data standard that the data source providers could come in to let's say, technology providers, vendors, or carriers that can actually glean the information back to the agent in quick, actionable segments so they can make decisions.

And give it to them in quick little snippets of, "What are we trying to say? What do you need to do?" Allow them to take action. They don't need to know that there's a whole data set with a 100,000 rows that's doing...they just need to know the end story. This is what the data is trying to tell me.

Ron:

This one is very clear. It's actionable. Actionable is the key word.

Dan is right. What would be better than being an agent—giving the best service you possibly can to a customer—and then to use business intelligence and even some predictive actions behind that? To be able to say, "You know what, this customer has a chance to move on, let's reach out to him and strengthen that partnership." Have a save for the carrier and the agency!

It's all about understanding the customer's needs, and just as Dan said, free and clear understanding of what you need to do with it. It's that actionable data. And that helps not only the big agencies that have multi-locations that can streamline at large scale, but also the typical Big I Agency, who is considered a small to small-medium agency. Just streamlining that agency, increasing efficiencies, and being able to serve your customer at much better speed and in much better ways.

Dan:

You guys both know me well. And you know, I'm a guy who makes analogies to make an analogy to make an analogy. So carriers in the industry are like a curling team. And our job is to throw the curl or whatever you call it, Ron. The pod...

Ron:

The Rock.

Dan:

The Rock down the ice. The data team, the service providers, we are the ‘broomers.’

We're trying to massage the data, all the information, so that it lands appropriately in the space that the agent can take the information and understand it. So, I think that we all serve a purpose, and our job right now with data is to help guide it where it needs to go. Ron is a professional curler…

Ron:

Not professional. I curl quite a bit.

Jason:

Oh wow.

Ron:

So to extend that analogy, and as an aside, I've curled quite a bit. I've never sat on a curling sheet and thought, "You know, this is a lot like data and the stakeholders."

But to extend it, there is a skip (captain) at the end of the ice that's calling the shots. As the stone gets to the house—that target at the end—the skip is making those last adjustments.

And that's the action so in your analogy, Dan, that would be the agent. We're the ones who are going to be the catcher's mitt for all of this. We're we are the eventual users of all of this. We need to be able to understand and guide what's coming to us. Wow. I would've never come up with that one, but that's a good analogy.

Dan:

And Jason, I would say that skip is exactly right. I think another big takeaway from data is, remember who we're doing it for. As providers or carriers or vendors, remember who we're doing it for, and sometimes ask the agent, "What is it you need? What is problems that we're trying to solve for you?" And make sure that our data meets what they're trying to do. Instead, what we do is we throw all this data at people and say, why aren't you using it? Well, it wasn't really the business problem they were trying to solve, possibly, or they didn't know how to use it.

Ron:

And that's a clear takeaway from all of the stakeholders, Jason, in the Data-Driven Industry Work Group that we'd identified out of the gate. We're creating a lot of data here. How much it was actionable? How much of it is needed, and what should we be doing with that core critical component?

Jason:

Well, this has been a great discussion. Both of you provided a lot of insight, which is fantastic.

Ron, back to you personally, when you're not in the office, you can be found ice fishing. Is that true?

Ron:

In the winter, I do it a lot. I'm in the Land of Lakes. I do it all winter. I dream about it all summer and I get ready all fall. There's something about being out on the frozen ice.

And lest anybody listening, think I'm sitting out there on a bucket at 40 below—I did that in my twenties.

Now, I have a camper ice fish house that you tow to a spot, you hit a button—it's on hydraulics—and it lowers down. It's got heated floors, a fireplace, full kitchen, bathroom. It's not roughing it.

But yeah, there's something about pulling a fish through the ice in the wintertime. Their flesh is so much firmer and tastier than summer. It's fantastic. And you don't have to wait in line with a bunch of other yahoos in the summer to back your boat in and access.

Jason:

We're going to post pictures of that, and also I'm going to post a video of you and your buddies making the carousel with the ice.

Ron:

The ice carousel. Yes.

Jason:

We’re out of time! Thank you both for being on the podcast.

Ron:

My pleasure.

Dan:

Thank you. Thank you, Ron.